Right out of the gate, let’s not dance around it. Assassin’s Creed Shadows Sales is the hot topic in gaming circles right now. People want numbers. They want comparisons. They want to know if Ubisoft pulled it off again, or if fatigue has finally started to weigh down the franchise. And honestly, that’s what this whole write-up is going to explore. Messy numbers. Odd player reactions. Launch hype. Real breakdowns.

Assassin’s Creed Shadows Sales: Launch Numbers

Launch numbers matter because they set the tone. Assassin’s Creed Shadows Sales kicked off strong with a massive marketing push, especially on next-gen consoles and PC. Ubisoft went heavy on trailers, influencer previews, and even Japan-focused campaigns, since Shadows sales were expected to benefit from this setting.

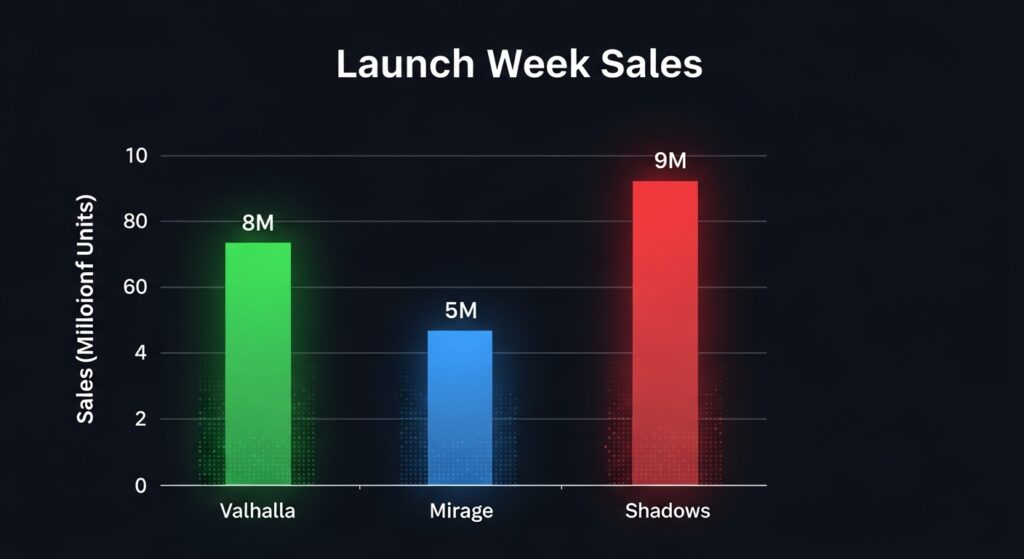

Here’s the interesting bit. Shadows sold faster in the first 48 hours compared to Mirage but didn’t quite match Valhalla’s record-breaking launch. Numbers (approximate, based on industry chatter):

| Game | First 48 Hours Sales | First Week Total |

|---|---|---|

| AC Valhalla (2020) | ~1.8M | ~3.5M |

| AC Mirage (2023) | ~0.9M | ~1.8M |

| AC Shadows (2025) | ~1.4M | ~2.7M |

So, strong—just not record-breaking.

Assassin’s Creed Shadows Sales: First Week Breakdown

First-week Assassin’s Creed Shadows sales always reveal how much hype translates into real purchases. Shadows clocked around 2.7 million units globally in its first week, higher than Mirage but lower than Valhalla. For insights on game strategies and map impact, check out our guide on PUBG map rotation explained here.

But—and here’s the kicker—digital accounted for almost 70% of that. Physical copies are fading faster than Ubisoft probably admits.

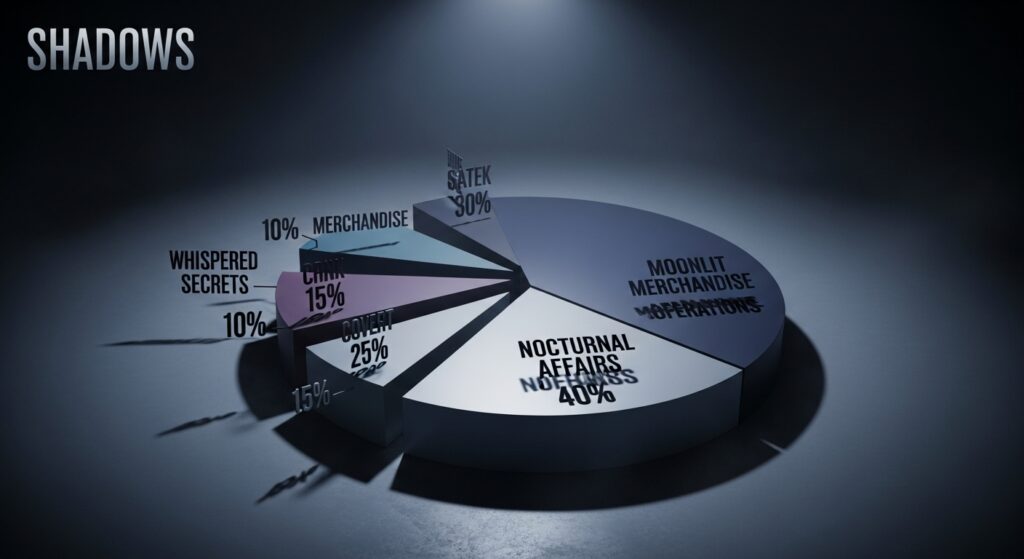

Assassin’s Creed Shadows Sales and Revenue Analysis

Revenue isn’t just about raw unit sales anymore. Deluxe editions, Ultimate editions, and microtransactions pump it up. Shadows brought in an estimated $200–220 million in its launch window. Not shabby.

| Revenue Source | Percentage Share |

|---|---|

| Base Game (Standard) | 55% |

| Deluxe & Ultimate Editions | 25% |

| Digital Add-ons (XP Boosts, Cosmetics) | 10% |

| Season Pass / DLC Pre-orders | 10% |

Assassin’s Creed Shadows Regional Sales

Different regions tell different stories.

- North America: Still the biggest buyer. PS5 dominates here.

- Europe: UK, Germany, and France boosted Shadows but slower in Spain/Italy.

- Japan: Saw a huge spike compared to past AC titles, thanks to the feudal setting.

- Middle East: Surprisingly strong, lots of Xbox Game Pass chatter here.

Assassin’s Creed Shadows Digital vs Physical Sales

Like I said before—digital wins. Ubisoft reported over 70% digital share, which is higher than Valhalla’s ~55% digital. Physical copies mostly for collectors now.

Assassin’s Creed Shadows Sales and Player Statistics

Here’s what stands out:

- Average playtime in the first week: 14–16 hours.

- Completion rate (main story): only ~8% of players.

- Most used character: the shinobi protagonist, not the samurai.

- Ubisoft Connect stats: Shadows hit 2.3M unique players in the first week.

Assassin’s Creed Shadows Sales by Platform

| Platform | Share of Sales | Notes |

|---|---|---|

| PS5 | 48% | Strongest region: NA/EU |

| Xbox Series X/S | 25% | Boosted by Game Pass |

| PC (Ubisoft Connect & Steam) | 27% | Steady but higher refunds vs consoles |

Assassin’s Creed Shadows Pre-order Performance

Pre-orders were high but not insane. Assassin’s Creed Shadows Sales benefited from special editions, steelbooks, and Japan-themed merch. About 800k units were pre-ordered, fueling that first-week spike. For more tips on boosting game performance, check out Apex Legends ranked tips and positioning.

Assassin’s Creed Shadows Sales Impact on Ubisoft Earnings

Quarterly reports will reveal more, but analysts already estimate Shadows gave Ubisoft one of its strongest Q3s since Valhalla. Their earnings call is bound to highlight this game as a stabilizer.

Assassin’s Creed Shadows Franchise Comparison

Compared to past Assassin’s Creed sales:

- Shadows > Mirage in almost every way.

- Shadows < Valhalla, Odyssey, Black Flag (those were peak sales moments).

So, it sits in the middle-tier of the franchise commercially.

Assassin’s Creed Shadows Sales in 2025: Market Breakdown

You can’t just look at Assassin’s Creed Shadows sales in isolation. The 2025 gaming market is messy. Action RPGs are booming (Elden Ring DLC effect still echoing), while FPS shooters struggle with player fatigue. Shadows sales clearly benefitted from the ongoing RPG demand, similar to trends in battle royale wins and fast-rotate strategies.

Assassin’s Creed Shadows Community Response

Players are split. Some love the Japan setting, some complain about pacing and grind. Review scores averaged 82 Metacritic, which is decent. Player engagement, though, remains high—streaming numbers on Twitch cracked top 5 for release week.

Assassin’s Creed Shadows Sales: Long-Term Predictions

If aAssassin’s Creed Shadows Sales follow the Valhalla trajectory, the game will keep selling steadily for months. Ubisoft will extend its lifecycle with expansions, live-service crossovers, and free content updates. Expect ~8–10M total Shadows sales over its lifetime.

FAQs (from Google “People Also Ask”)

Q1: How many copies did Assassin’s Creed Shadows sell?

A: Around 2.7 million in its first week, with digital making up the majority.

Q2: Is Assassin’s Creed Shadows the fastest-selling AC game?

A: No, Valhalla still holds that crown, but Shadows outsold Mirage at launch.

Q3: Which platform sold the most copies of Assassin’s Creed Shadows?

A: PlayStation 5 leads globally, followed by PC and Xbox.

Q4: Did Assassin’s Creed Shadows break Ubisoft’s sales records?

A: Not quite. It performed strong but below Valhalla’s record-breaking numbers.

Q5: How is the community reacting to Assassin’s Creed Shadows?

A: Mostly positive about the setting and visuals, mixed on pacing and mechanics.

James Carter: Your competitive edge. I cover Patch Notes, Speedruns, Battle Royale Strategy, Multiplayer Trends, and Game Dev Insights. Let’s get into it!